Why a Fixed Index Annuity?

Could Be Your Shield Against Financial Uncertainty

In today’s world of economic volatility, rising inflation, and market downturns, many savers find themselves asking:

“Will I have enough money to retire securely?”

“What happens if the market crashes right before I need my savings?”

“How do I protect myself from outliving my retirement income?”

“Most people know how to save money, but ask yourself... does it matter where I save?

Is bank account the only solution?”

“Does gains with no loss account exist?”

The truth is — where you save money matters just as much as how much you save. At Master Wealth Builders LLC, we specialize in strategies that don’t just grow wealth but protect it. One of the most powerful long-term savings solutions is the Fixed Index Annuity (FIA).

---

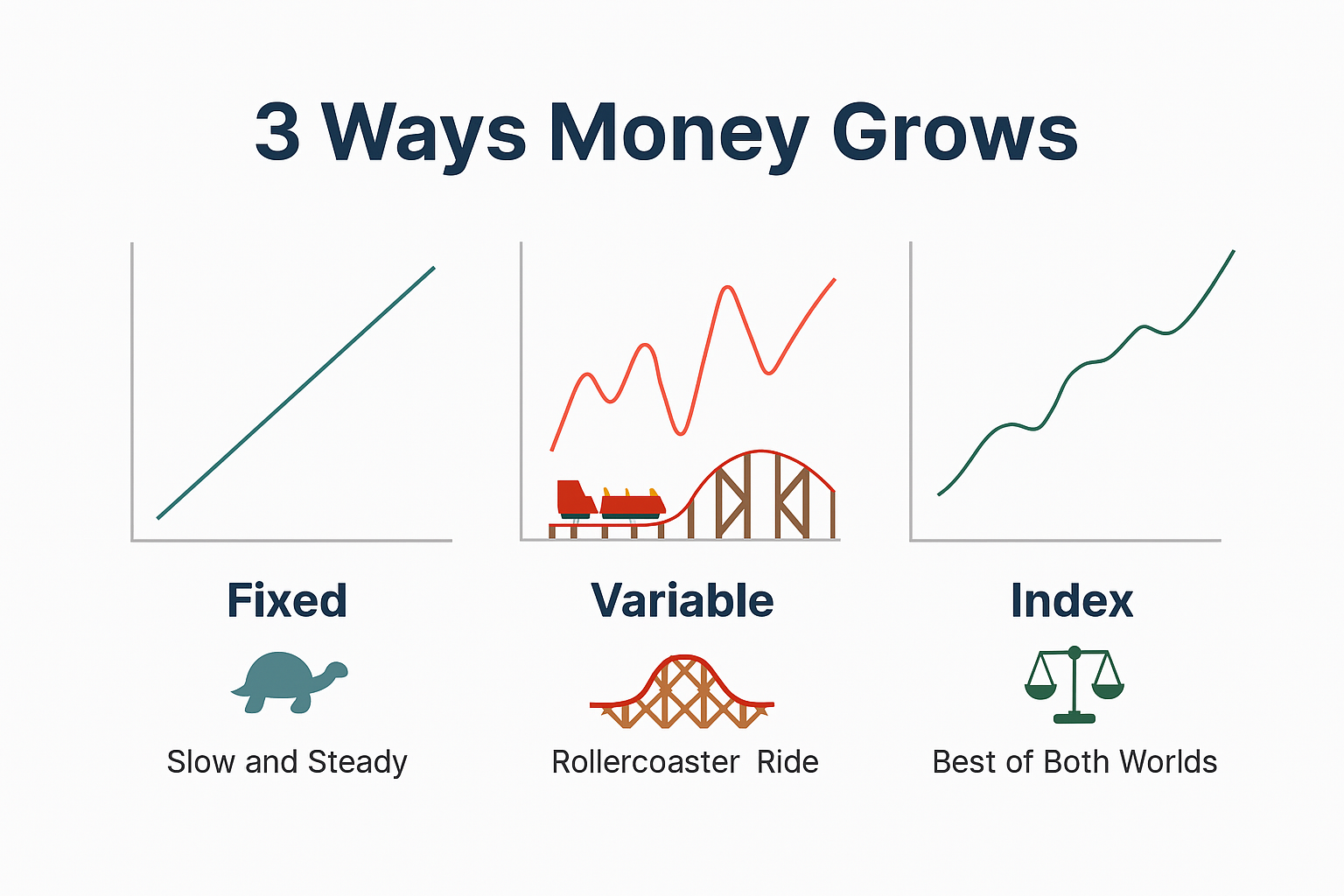

The Problem: Traditional Savings Vehicles Leave You Exposed

401(k)s and IRAs are directly tied to the market. When the market dips, so does your retirement.

Bank savings accounts are “safe,” but earn minimal interest that can’t outpace inflation.

CDs and bonds provide fixed interest, but without true growth potential.

In short, traditional savings options force you to choose between growth and safety. But what if you could have both?

---

The Solution: A Fixed Index Annuity

A Fixed Index Annuity combines market-linked growth with guaranteed protection of your principal. Think of it as a shield against volatility — one that uses the power of compound interest to build wealth over time.

Key Benefits of an FIA:

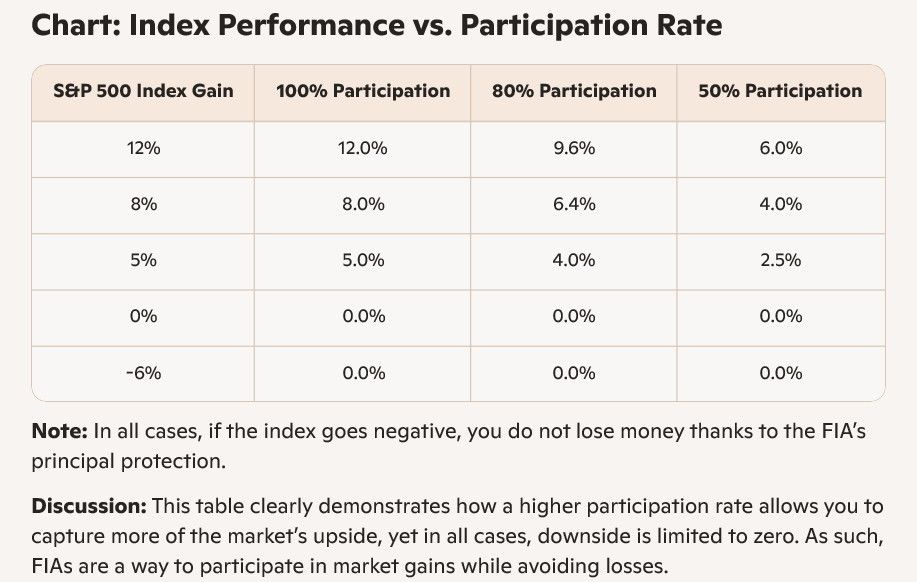

Market Growth + Downside Protection

Your annuity earns interest linked to a market index (like the S&P 500), but you never lose money due to market downturns.

The Power of Compounding

Your money compounds year after year. The longer it stays, the faster it grows — creating exponential results instead of linear ones.

Tax-Deferred Growth

Your savings grow without immediate tax burdens, allowing your nest egg to accumulate faster.

Lifetime Income Guarantee

An FIA can be structured to provide a guaranteed paycheck for life — no matter how long you live.

Peace of Mind

While others fear the uncertainty of markets, you’ll know your principal is safe and your retirement is secure.

---

Compound Interest: The Wealth Builder’s Secret Weapon

Simple interest may grow your money, but compound interest multiplies it. With an FIA, every dollar saved has the potential to generate returns that then generate more returns — creating a snowball effect over time.

This is how the wealthy protect and expand their wealth. Not through speculation, but through strategies that make compounding work relentlessly in their favor.

---

The Bottom Line

Uncertainty will always exist. Markets rise and fall. Inflation eats away at savings. Taxes can change overnight. But with the right financial strategy, you don’t have to live in fear.

A Fixed Index Annuity positions you to:

- Grow your wealth safely.

- Protect your principal.

- Secure lifetime income.

Harness the true power of compound interest.

---

Take Control of Your Future

At Master Wealth Builders LLC, we believe financial literacy is the first step to financial freedom. Don’t leave your future to chance or uncertainty.

Schedule Your Free Consultation Today

Discover how a Fixed Index Annuity can protect your money, grow your wealth, and give you the retirement security you deserve. Visit Master Wealth Builders LLC and book your free consultation now.

Because in uncertain times, the smartest investment you can make is in certainty itself.