How does participation rate work in FIA

Within a Fixed Index Annuity, What is Participation Rate?

Introduction

Navigating the world of retirement planning can feel overwhelming, especially when faced with unfamiliar financial products and industry jargon. One product attracting considerable attention from those seeking safe, growth-oriented retirement assets is the fixed index annuity (FIA). At the heart of understanding the growth potential of an FIA lies a key concept: the participation rate. But what does "participation rate" really mean for investors, and how does it impact your potential earnings? In this comprehensive, accessible blog, we’ll demystify the concept of participation rate in FIAs, using simple explanations, real-world examples, and visual analogies. We’ll also explore how participation rates fit into the broader landscape of limiting features like caps and spreads, and discuss compliance considerations. By the end, you’ll be equipped with both the knowledge and confidence to assess FIAs and who they might be right for. Ready to dig in? Let’s make sense of participation rates—step by step.

What Is a Fixed Index Annuity?

Setting the Stage

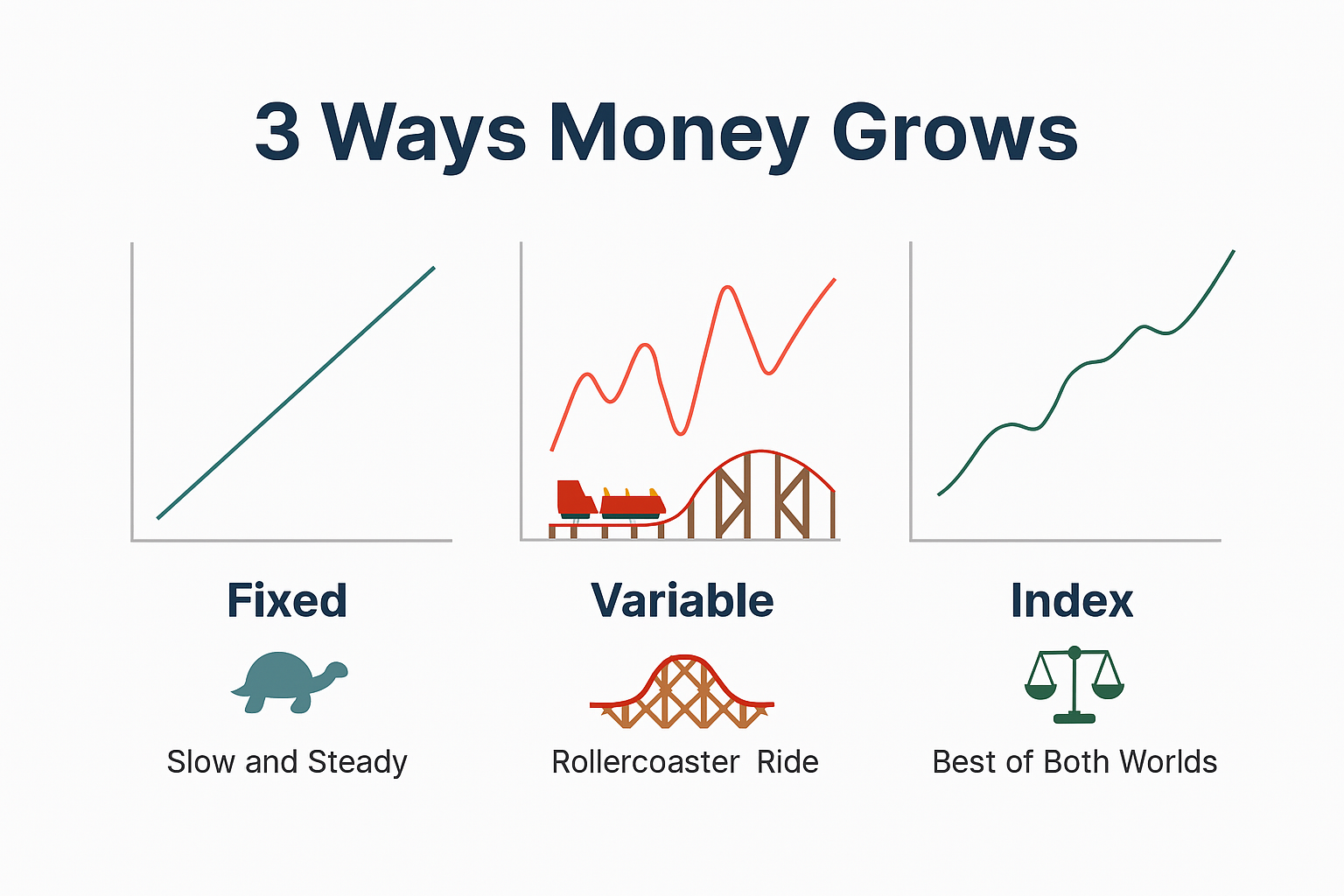

Before we tackle participation rates, let’s briefly clarify what FIAs are and how they fit into your retirement toolbox. A fixed index annuity is a financial product offered by insurance companies that combines principal protection with the opportunity for gains linked to a market index, like the S&P 500, Dow Jones, or Nasdaq. Unlike investing directly in the stock market, with FIAs your money is not actually invested in stocks or bonds. Instead, your returns are linked to the performance of a specified index, providing the potential for higher returns than a regular fixed annuity (which pays a guaranteed but usually modest rate) while still offering protection from market downturns. In simple terms, FIAs let you “ride along” with market growth but shield you from market losses.

Key features:

- Principal protection: Even if the market goes down, your annuity value won’t decrease due to poor market performance (though withdrawals and fees may affect value).

- Market-linked growth: Your gain is determined in part by how well your chosen index performs.

- Limiting factors: Your upside (the amount you can gain from market growth) is typically limited by participation rates, cap rates, or spreads.

It’s this last point—how upside is calculated and limited—that brings us to participation rates, the focus of our blog.

Defining the Participation Rate in FIAs

So, what exactly is the participation rate in the context of a fixed index annuity?

The participation rate is the percentage of an index’s gain (over a set period, typically one year) that an insurance company credits to your annuity account.

- If the participation rate is 100%, you are credited with the full percentage increase of the index (subject to any caps or spreads).

- If the participation rate is 80%, you're credited with 80% of any index increase.

- If the index goes down or doesn't increase, depending on the product, your credited interest may be zero, but you don't lose your principal.

In plain English: If the chosen market index increases by 10% in a year and your participation rate is 80%, your account is credited with an 8% gain (80% of 10%).

The participation rate is typically set by the insurer and is detailed in your annuity contract. In many cases, it can be reset annually or periodically at the insurer’s discretion, so it’s important to understand both the initial rate and whether (and how often) it can change.

Visual Analogy: Participation Rate as a Ticket to the Market’s Roller Coaster

Imagine the index is a roller coaster at an amusement park, zooming up and down throughout the year. A fixed index annuity is like having a ticket that lets you experience only part of those thrilling ups, but none of the scary drops.

- The participation rate is like the height restriction on the roller coaster: it limits how much of the ride’s highs you can experience. If it’s set at 80%, you only get 80% of the way to the top on each ascent.

- Importantly, you never go down with the drops (market declines)—you simply stay where you are.

This ensures the ride is both more predictable and less risky.

Participation Rate vs. Other Limiting Features:

How It Fits In

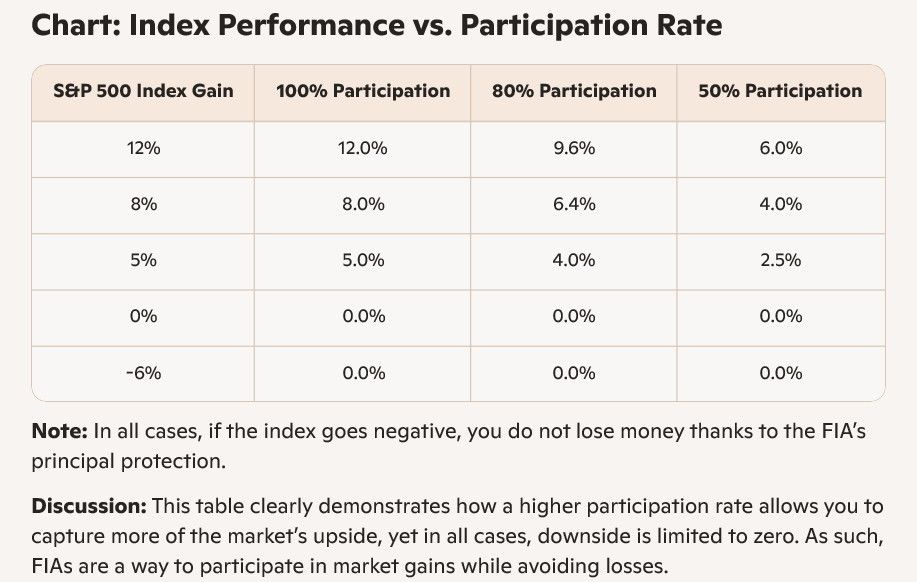

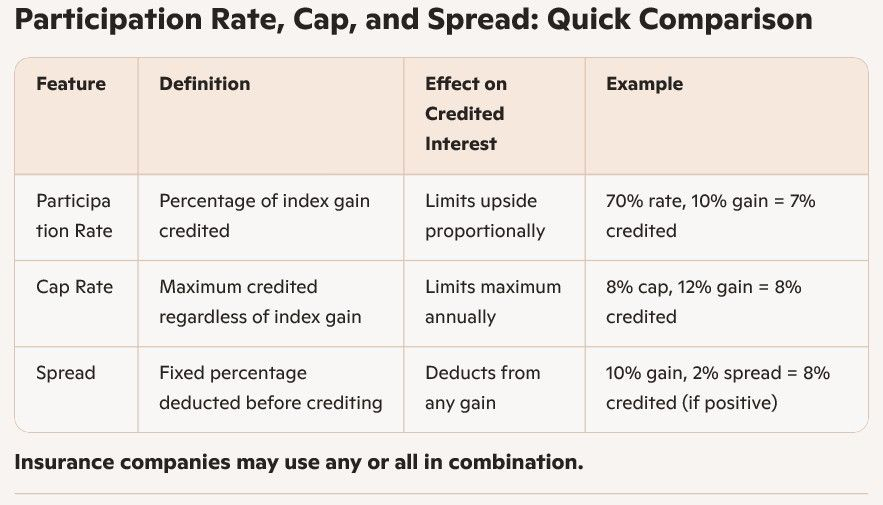

The participation rate is one of several features that insurers use to calculate how much of the market’s return you get. The main types of limiting factors in FIAs are:

- Participation Rate: As defined, the percentage of index growth credited to your account.

- Cap Rate (Interest Cap): The absolute maximum amount of interest you can earn, regardless of index performance.

- Spread (or Margin/Asset Fee): A fixed percentage that is deducted from the index’s return before your participation rate is applied.

In some contracts, you may see just one of these features; in others, you may find two or even all three limiting your credited interest. For example, a contract could have an 80% participation rate and a 7% cap—if the index goes up by 12%, first you get 80% of that (9.6%), but the cap would reduce the credited interest to 7%.

Simple, Step-by-Step Example:

How Participation Rate Affects Returns

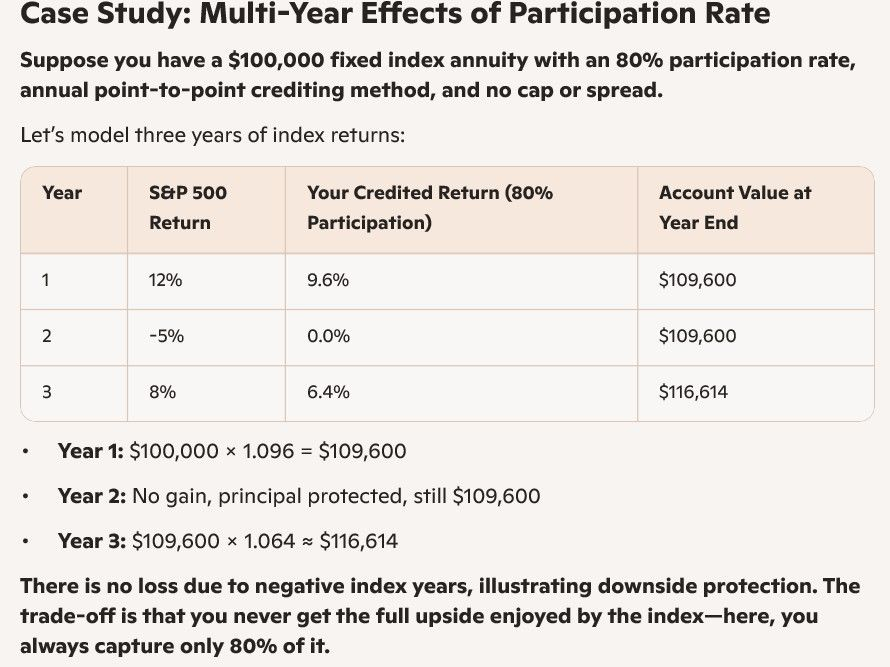

Let’s walk through a hypothetical case:

Scenario

- You invest $100,000 in an FIA tied to the S&P 500.

- Participation Rate = 75%

- No cap, no spread for simplicity.

Suppose, over one year, the S&P 500 increases by 10%.

Calculation:

- Index gain: 10% (S&P 500 return)

- Your participation: 75% of 10% = 7.5%

- Interest credited: $100,000 × 7.5% = $7,500

If the index drops by 8%:

- Participation rate or not, negative returns do not reduce your account value—your principal is protected, so interest credited is 0%, not negative.

If the contract included a cap:

- Suppose there’s also a 6% cap.

- Even if the 75% participation would give you 7.5%, your maximum credited interest is 6%.

If there’s a spread:

- Example: 75% participation and a 2% spread. Index rises 10%.

- First, 10% × 75% = 7.5%. Then, subtract 2% = 5.5% credited to your account.

These combinations are common, so always check the contract details.

Illustration: The “Sunglasses Filter” Analogy

Visualize the participation rate as a pair of sunglasses filtering sunlight. The sun represents the market index—the brighter the sun, the more “growth rays” it sends your way. The darker the sunglasses (lower the participation rate), the less of that sunlight (returns) gets through. If the sun goes behind a cloud (market drops), the sunglasses block nothing—you simply see zero.

So:

- 100% participation = clear lenses: you get all the light (index growth).

- 80% participation = moderately dark: you get some, but not all, beneficial rays.

- 50% participation = very dark: you get half the sunlight—your growth potential is cut in half.

This filter analogy reveals why understanding participation rate is so crucial: it determines how much potential for growth reaches your contract.

Real-World Participation Rate Levels:

What Do Insurers Offer?

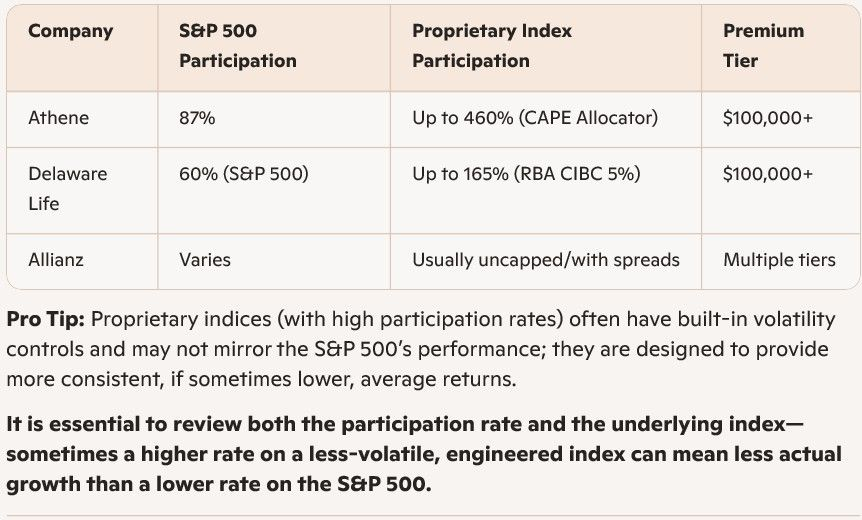

Participation rates are not fixed across the industry. They fluctuate based on general interest rate environments, the insurer’s investment strategy, the chosen market index, contract length, and product competitiveness.

Typical current ranges (as of fall 2025):

- Traditional S&P 500 strategies: 60% to 90% participation rates are common, though some can be higher, especially for larger premium tiers.

- Example: Athene offers 87% participation rates on the S&P 500 for accounts with $100,000 or more in premium.

- Proprietary or volatility-controlled indices: Participation rates can be even higher, sometimes 150% to 460% or more.

- Example: Athene’s CAPE Allocator strategy shows rates above 400% for premium tiers over $100,000.

Why Insurers Use Participation Rates:

Risk and Balance

Why wouldn’t insurers simply offer 100% (or higher) participation rates on stock indices in every case?

The answer is risk management. By offering participation rates below 100%, insurers can:

- Protect themselves from having to pay out unsustainable interest if the market surges dramatically.

- Account for their own investment and operational costs, including hedging against market movements.

- Make the product sustainable while still ensuring client principal is protected even in major market downturns.

If insurers allowed 100% participation (uncapped, no spreads), it would be difficult to guarantee zero downside to contract holders, especially during years when market options become expensive to purchase.

The trade-off is fundamental: You, as the policyholder, accept less of the upside return in exchange for guaranteed downside protection and principal security.

Choosing Strategies and Participation Rate Products

Most FIAs allow you to allocate your premium across several strategies:

- Fixed Account: A set, fixed interest rate.

- Index Strategies: These use different indices and different limiting features (caps, spreads, participation rates).

- Multiple Indices: Many products offer choices among indices (S&P 500, Russell 2000, proprietary, volatility-controlled, etc.), each with their own participation rates and other limits.

- Trigger Strategies: These credit a set amount if the index stays flat or goes up (e.g., 8%).

Each strategy will likely have different participation rates and risk/reward profiles. One may offer a higher rate but be subject to a cap; another may offer unlimited growth but with a lower rate.

Pro tip: For those seeking higher growth potential and comfortable with some variability, choosing the strategy with the highest participation rate can make sense, but evaluate the underlying index for consistency with your goals.

Participation Rate and Retirement Planning:

Why It Matters

For people planning retirement, participation rate is critical because it directly impacts the long-term growth of your annuity. A higher participation rate can mean higher average credited interest over the contract period, resulting in a bigger nest egg. However, participation rates are just one factor—you must balance them against other product features like:

- Length of surrender charge period,

- Flexibility of withdrawals,

- Guarantees and minimum credited rates,

- Insurance company stability.

A reasonable approach is to select an FIA with a competitive participation rate on a familiar index (like the S&P 500), from a highly rated insurer, to maximize potential growth within your risk tolerance.

Take the Next Step Toward

Maximizing Your Retirement Savings

Are you curious how a higher participation rate could boost your FIA’s growth potential? Let a seasoned retirement specialist walk you through customized options that fit your goals.

Schedule your FREE consultation with a Master Wealth Builders professional now!

It’s the easiest way to get personalized, non-binding answers on participation rates, caps, spreads, and all your FIA questions—no sales pressure, just clear advice.

Recent Posts