Put These Strategies to Work:

The Million Dollar Baby

We'd like to introduce you to an exciting opportunity we call the "Million Dollar Baby Plan." We believe this plan could be a significant step in securing your child's financial future and overall well-being.

The "Million Dollar Baby Plan" is built around the strategic utilization of an insurance policy as a valuable asset for your child. This approach is designed to ensure they not only have a substantial financial foundation for future needs, such as education or starting a business, but also benefit from excellent insurance coverage that provides comprehensive protection throughout their life. We are confident that this plan can offer both peace of mind and tangible benefits for your child as they grow.

Implementation involves max fund IUL and/ or fixed index annuity (25k min if under 18).

Redirection Strategy

We want to share our "Redirection Strategy" to help you use your current assets to build the future you envision, potentially with no upfront cash out of pocket.

Here's how it works:

Option 1: Rollover Existing Cash Accounts

You can redirect any cash account you own (such as 40xx accounts) into a Fixed Indexed Annuity (FIA) through a rollover.

Option 2: Utilize Home Equity

You can use home equity from an interest-only Home Equity Line of Credit (HELOC) to finance a 10-year FIA. The interest you earn on the FIA is designed to be higher than the interest on the loan, leveraging the rule of 72 to potentially double your money within 10 years through compound interest.

We're happy to demonstrate the math for you in a free, one-on-one consultation with an illustration. Our process is simple: sign the illustration, then submit the application, and you're all set.

Why consider a Fixed Indexed Annuity (FIA)?

Principal Protection

FIAs can help protect your principal from market fluctuations, putting you in a no-loss situation. You gain from some of the market's upside potential without the downside risk. A common guideline is to subtract your age from 100 to determine the percentage of your portfolio that could be in a principal-protected account like an FIA or Max Fund IUL.

Income for Life

The FIAs we offer can provide payments until age 114, ensuring a lifetime income for most. The amount you accumulate before annuitizing (beginning payments) can continue at level or increase/adjust with market value (depending on your chosen annuity goal), much like a pension.

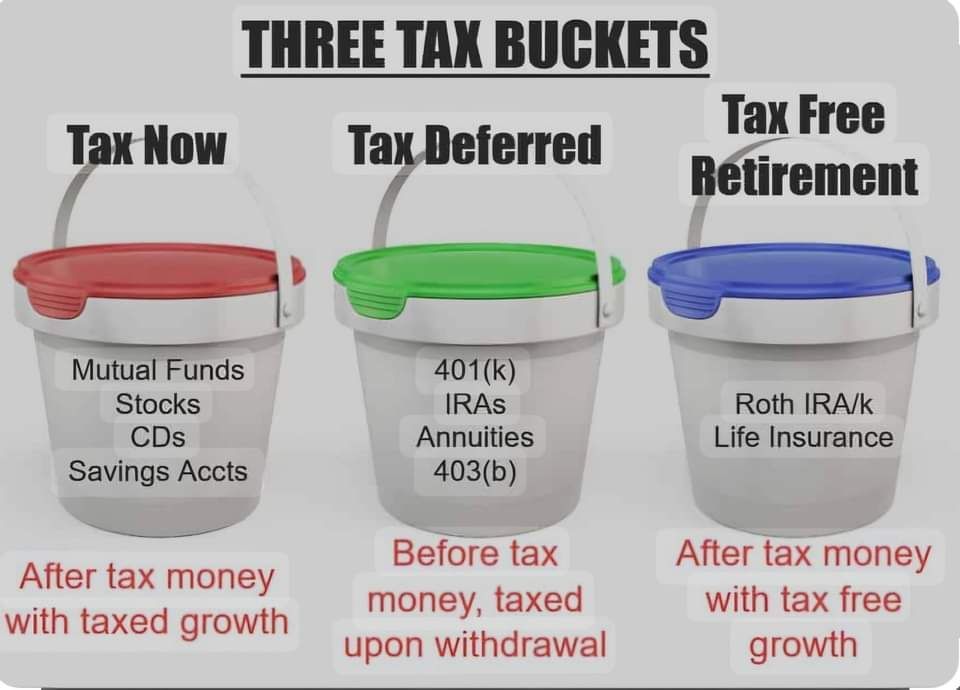

Tax Advantage

Money within an FIA grows tax-deferred, meaning you don't pay taxes on the interest gained until payments are made. You also have the flexibility to roll it into a Roth or place it within a family trust.

Compound Interest

Unlike typical cash accounts that offer simple interest, FIAs utilize compound interest, which is similar to a penny doubling every day. This exponential growth can help your money grow faster with the same amount of time and initial input.

Please let us know if you have any questions or would like to schedule a free consultation.

The Waterfall Method

Accumulation

A parent or grandparent purchases a whole life insurance policy on themselves or a younger family member (child or grandchild).

Tax-Deferred Growth

The policy accumulates cash value over time, with growth generally tax-deferred.

Transfer

The policy can be transferred to the younger generation (the insured) either during the policyholder's lifetime or upon their death.

Beneficiary Designation

The policy can be structured to pass directly to the next generation, potentially avoiding probate and estate taxes.

Family Banking

The cash value of the policy can be accessed through policy loans to fund family needs, like education or business ventures, and then repaid, perpetuating the cycle.

Perpetuation

The death benefit from the policy can be used to purchase new policies on subsequent generations, creating a continuous cycle of wealth transfer.

Key Benefits

Tax Advantages

Whole life insurance offers tax-advantaged growth and potentially tax-free death benefits.

Estate Planning

It can help streamline wealth transfer, potentially reducing estate taxes and avoiding probate.

Family Legacy

It creates a mechanism for long-term wealth preservation and transfer to future generations.

Family Banking

The cash value can be used as a source of internal financing for family needs.

Variations

The Waterfall Method can be customized based on individual circumstances and objectives, with variations including:

Trust Integration

Using trusts to hold the life insurance policies and manage the distribution of wealth.

Multiple Generations

Extending the strategy to include multiple generations (grandparents, parents, children, grandchildren).

Different Policy Types

Exploring different types of life insurance policies based on specific needs and goals. Whole life with average 4% dividends or IUL at 6.5% compounding interest.

My Personal Strategy for 3M Dollar Annuity Portfolio Allocation

AE Income Shield $300k

14% bonus - Lifetime Income (Pension) & Well being Rider 6.5 fixed compounded rate (LIBR Option 2) with market participation tradeline rate credits. Allows 10% penalty free withdrawal of total contract value stair step in years 2-10 Ex: Year 4- 40% 5- 50%

The Income Shield series provides tailored approaches to guaranteed lifelong income, with two Lifetime Income Benefit Riders to choose from.

AE Asset Shield $300k

21% bonus - Asset Accumulation Growth with Enhanced market participation rates towards, Blackrock, Nasdaq, Etc. for the 1st ten years of maturity .95% charge per year. Allows 2% penalty free withdrawal in the first year and up to 12% of contract value in years 2-10.

The Asset Shield series helps people grow retirement dollars on their own timeline with 5, 7, and 10-year surrender charge schedules, and a performance rate rider that can boost accumulation, for a fee.

AE Estate Shield $300k

A guaranteed 35% Benefits Account Value Bonus on all first year premiums- this is different from Bonus Interest Lifetime Income (Pension) & Well being Rider 6.5 fixed compounded rate with market participation tradeline rate credits. This vehicle is a hybrid of both Asset Shield and Income Shield because it still allows you to earn interest and grow after activating the income portion which allows the income from year to year to increase. Allows 10% penalty free withdrawal of total contract value stair step in years 2-10 Ex: Year 4- 40% 5- 50%

Estate Shield 10 helps retirees build an income stream that has the potential for annual increases as well as death benefits to help leave a legacy.

KaiZen $600k

5 year retirement plan that offers 3 to 1 match using bank loan. Maturity in 10 years, bank take back loan, you keep interest. Allows up to 60% more growth.

Kaizen, also known as Kai-Zen, is a financial strategy that leverages premium financing to enhance an Indexed Universal Life (IUL) insurance policy. It allows individuals to potentially accumulate more cash value within the policy by using a bank loan to partially fund the premiums. This can lead to a more substantial death benefit and potentially greater tax-advantaged retirement income compared to a traditional IUL.

DUPLICATE SAME ALLOCATION = 3M

This is a short introduction. Please take the time to schedule a free consultation today to learn more.

Quick Links

Business Hours

- Mon - Sat

- -

- Sunday

- -