Simple Way to Participate in Gains Without Losses

MWB: "Where Vision Becomes Wealth"

3 Ways Money Grows: Fixed, Variable, and Index

When it comes to retirement planning, one of the biggest fears is losing money. Market downturns can wipe out years of savings, leaving you stressed about your financial future. But what if there was a way to capture market gains without risking losses?

That’s where Fixed Index Annuities (FIAs) come in. Let’s break it down in simple terms.

📈 The 3 Ways Money Grows

- Fixed Growth

- Example: A traditional savings account or CD.

- Your money grows at a set interest rate (e.g., 2%).

- Safe, but growth is limited.

- Variable Growth

- Example: Stocks, mutual funds, or 401(k) investments.

- Your money grows (or shrinks) based on the market.

- High upside potential, but also high risk.

- Index Growth

- Example: Fixed Index Annuity (FIA).

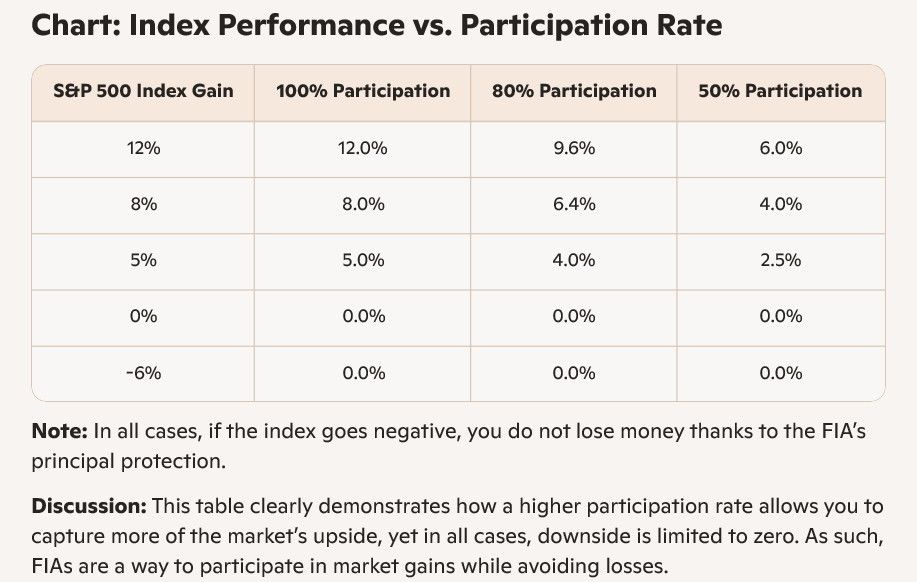

- Your money is linked to a market index (like the S&P 500).

- You earn when the market goes up, but you’re protected from losses when the market goes down.

Think of it like this:

- Fixed = Slow and steady 🐢

- Variable = Rollercoaster ride 🎢

- Index = Best of both worlds ⚖️

🛡️ Why a Fixed Index Annuity Can Benefit Your Retirement

Imagine you’re climbing a mountain. With stocks, you can climb fast—but you risk falling off the cliff. With a savings account, you’re safe, but you barely move upward. With an FIA, you climb steadily, and if you slip, there’s a safety harness that prevents you from falling below where you started.

Key Benefits of FIAs:

- ✅ No market losses – Your principal is protected.

- ✅ Upside potential – Earn interest when the market rises.

- ✅ Tax-deferred growth – Pay taxes later, not now.

- ✅ Lifetime income options – Turn savings into guaranteed retirement income.

- ✅ Death benefit protection – Your loved ones receive the account value.

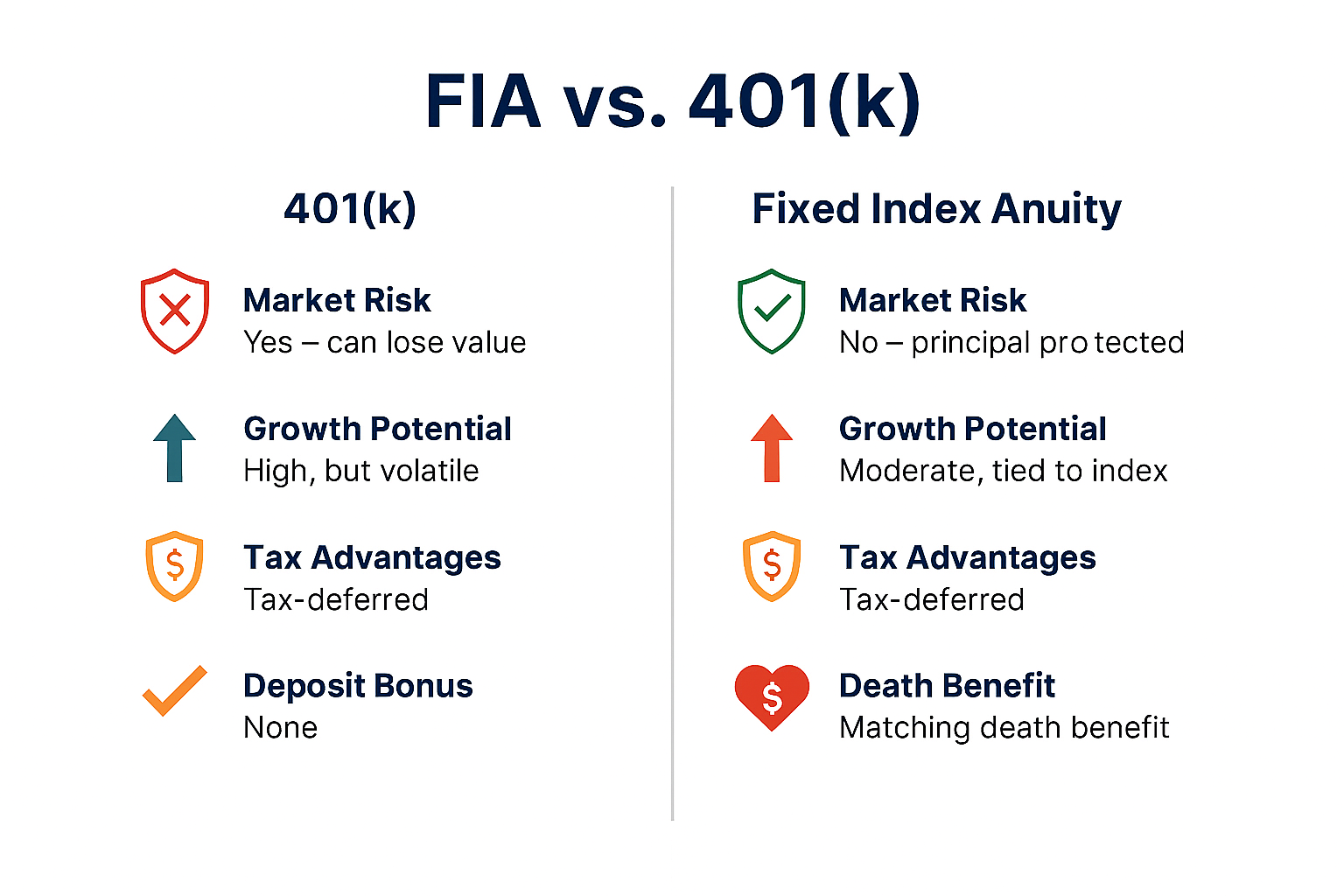

📊 FIA vs. 401(k): A Quick Comparison

🌟 Exclusive MWB Advantage

At Master Wealth Builders (MWB), there’s a unique FIA option that goes beyond the basics:

- 💰 Up to 22% deposit bonus on rollovers + anything else deposited in the first 12 months.

- 🪙 Matching death benefit equal to your account value.

- 🔒 Protection from market downturns while still participating in gains.

This means your retirement dollars can grow faster, safer, and smarter.

📌 Final Thoughts

Retirement planning doesn’t have to be stressful. With a Fixed Index Annuity, you can enjoy the upside of the market without the downside risk. Add in MWB’s exclusive deposit bonus and matching death benefit, and you’ve got a powerful tool to secure your financial future.

🚀 Take Action Today

Don’t wait until the next market downturn to protect your retirement. Schedule your free consultation today and discover how you can grow your money without losses: 👉 Schedule a Free Consultation

Recent Posts