Why Your Account Manager Won’t Tell You About Fixed Index Annuities

Here’s a truth most investors never hear:

your account manager likely won’t bring up Fixed Index Annuities (FIAs)—not because they don’t work, but because it’s not in their firm’s best interest. Let’s break down why.

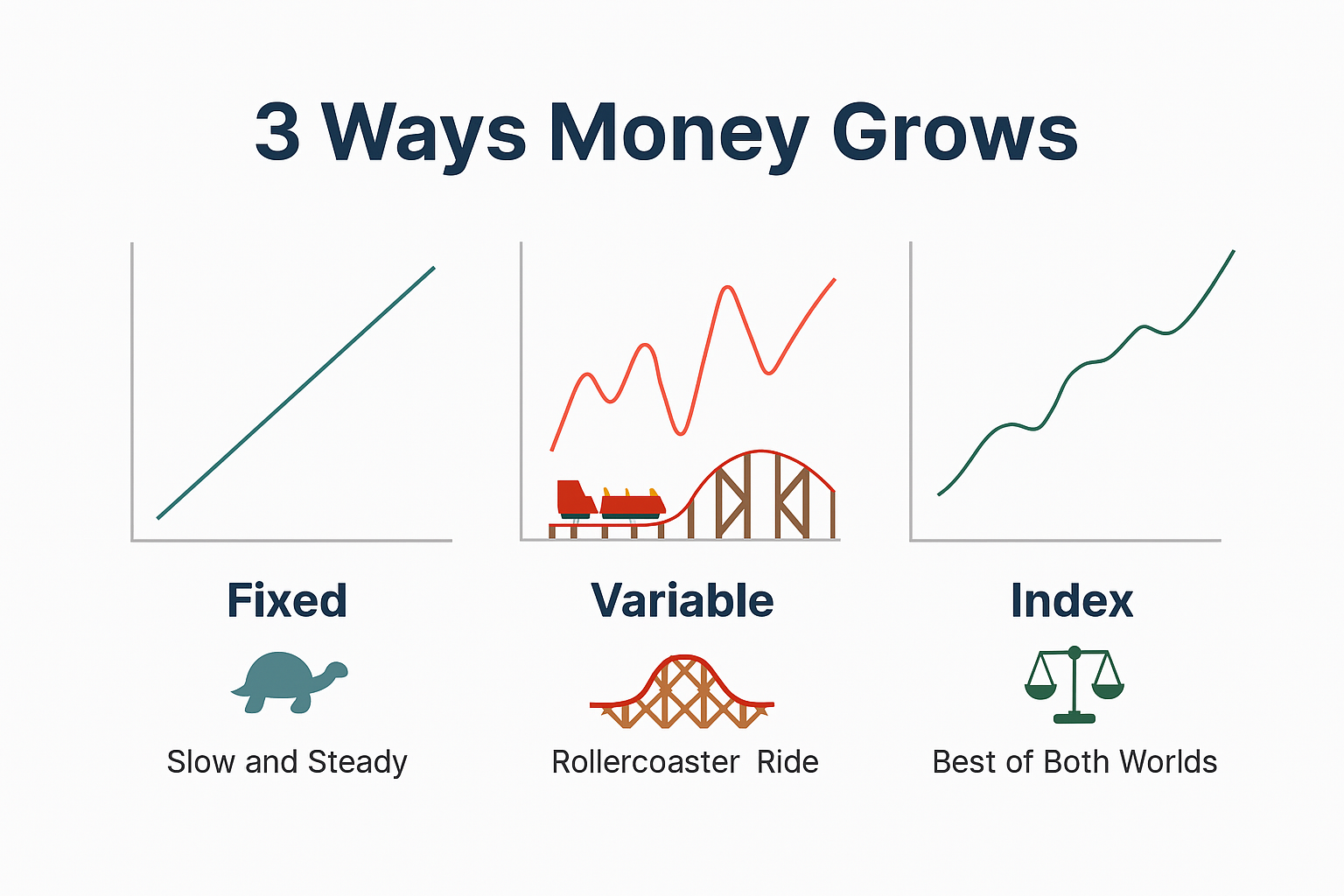

On the Market vs. Off the Market

Your account manager is trained to keep your money “on the stock market.” That’s where their firm makes money—through management fees, commissions, and trading activity.

A Fixed Index Annuity, however, takes your money off the market. It’s not exposed to the daily rollercoaster of stocks. Instead, it ties growth to an index (like the S&P 500), without the risk of losing your principal during market downturns. For many firms, this is a conflict of interest—if your money isn’t in the market, they can’t charge fees on it.

Fees vs. No Fees

Think about it: an average managed investment account might charge you 1% or more in fees every year. That doesn’t sound like much, but on $500,000, that’s $5,000 annually—money you’ll never see again, whether the market is up or down.

By contrast, most FIAs are no-fee products. Your growth is linked to the market’s upside, but without ongoing “management” costs draining your account.

Principal Protection vs. Market Volatility

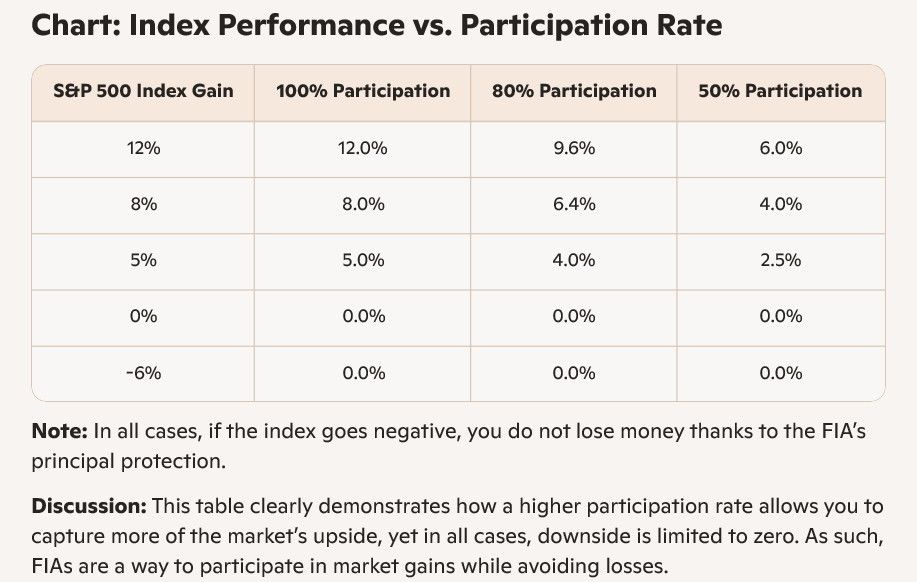

In a volatile market, even strong years can be wiped out by one bad crash. Lose 30% in one year, and it might take years of gains just to break even.

With a Fixed Index Annuity, you don’t lose your principal—ever. The worst-case scenario is 0% growth for the year, not a negative return. That “no loss” foundation gives your money the chance to compound steadily over the long term, which historically outpaces accounts exposed to repeated market downturns.

Tax-Deferred Growth vs. Fully Taxed Gains

Here’s another hidden benefit: FIAs grow on a tax-deferred basis. That means your money compounds faster because you aren’t paying taxes on gains every single year.

Contrast that with brokerage accounts: every trade, every dividend, every realized gain is a tax event. Uncle Sam takes his cut long before you see the long-term benefits.

Why You Don’t Hear This from Your Account Manager

Simple—most account managers aren’t licensed to talk about annuities. Only insurance-licensed professionals can explain or sell them. On top of that, if they did recommend an FIA, it would take money out of their firm’s fee-based system. That’s why you’ll almost never hear them suggest this path, even when it may be a smarter, safer option for your goals.

Example: Stock Market vs. FIA

Investor A: $100,000 in a managed stock account. Over 20 years, after fees and a few down years, the account grows but takes major hits along the way.

Investor B: $100,000 in a Fixed Index Annuity. No fees, no negative years. Growth compounds without setbacks. Even if Investor B’s annual growth is more modest, the power of avoiding losses typically results in a stronger balance long-term.

The Bottom Line

Fixed Index Annuities aren’t for everyone—but if you value principal protection, tax-deferred growth, and steady compounding without fees, they deserve a serious look.

Your account manager may not tell you about them. But we will.

Schedule your free consultation today at: www.masterwealthbuildersllc.com.

We’ll walk you through how FIAs work, whether they fit your retirement strategy, and why sometimes the smartest move is the one Wall Street doesn’t talk about.