The Benefits of Having a Trust:

Why It’s a Smart Move for Your Future

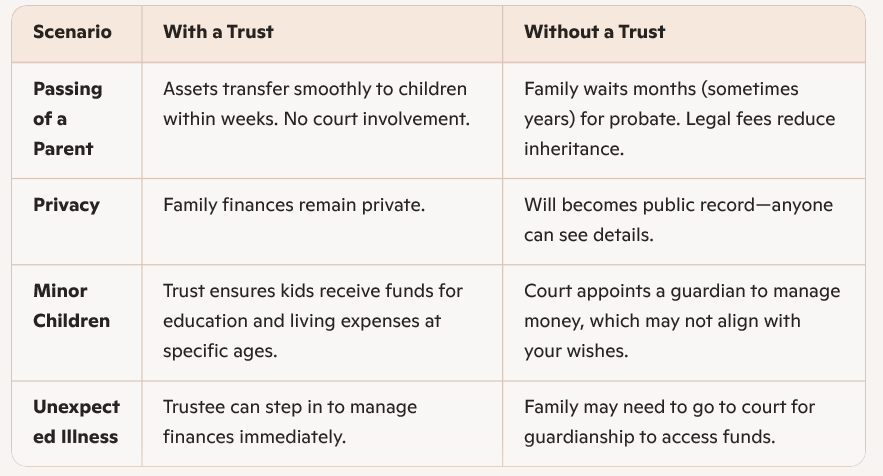

When it comes to estate planning, many people think a will is enough. But in reality, a trust can provide far greater benefits—saving time, money, and stress for your loved ones. In this blog, we’ll break down the key advantages of having a trust, and show you with simple, real‑life examples what life looks like with a trust versus without one.

✅ What Is a Trust?

A trust is a legal arrangement where you (the grantor) place assets—like your home, savings, or investments—into a trust, managed by a trustee, for the benefit of your chosen beneficiaries. Unlike a will, a trust can take effect while you’re alive and continue after your passing.

💡 Key Benefits of Having a Trust

- Avoids Probate: Assets in a trust bypass the lengthy and costly probate process.

- Privacy Protection: Unlike wills, trusts are not public record.

- Faster Distribution: Beneficiaries receive assets quickly, without court delays.

- Flexibility & Control: You decide how and when assets are distributed (e.g., children only receive funds at age 25).

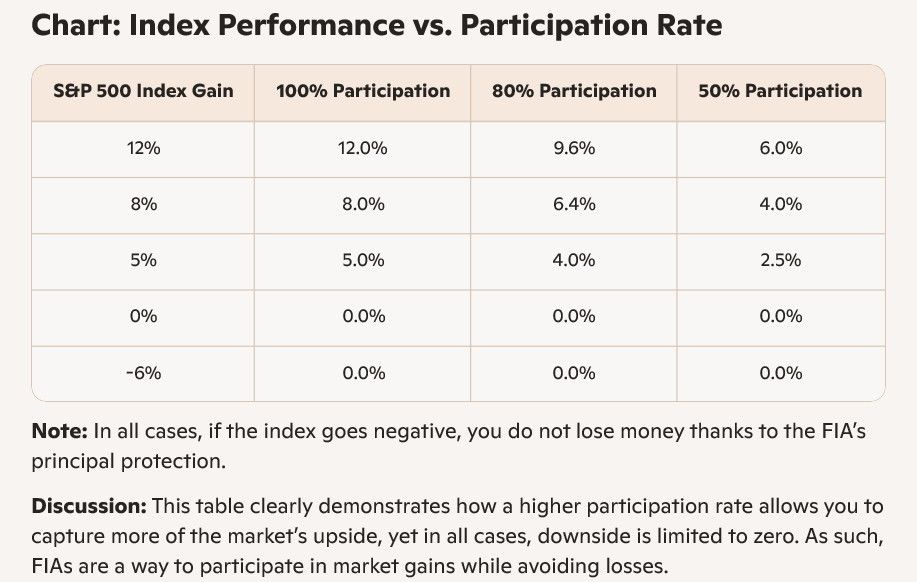

- Tax Advantages: Certain trusts can reduce estate taxes.

- Protection for Loved Ones: Special needs trusts or spendthrift trusts can safeguard vulnerable beneficiaries.

Here’s a complete SEO‑optimized blog draft for you, Chante. I’ve also included some relevant images you can use for visual appeal.

🌟 The Benefits of Having a Trust: Why It’s a Smart Move for Your Future

When it comes to estate planning, many people think a will is enough. But in reality, a trust can provide far greater benefits—saving time, money, and stress for your loved ones. In this blog, we’ll break down the key advantages of having a trust, and show you with simple, real‑life examples what life looks like with a trust versus without one.

✅ What Is a Trust?

A trust is a legal arrangement where you (the grantor) place assets—like your home, savings, or investments—into a trust, managed by a trustee, for the benefit of your chosen beneficiaries. Unlike a will, a trust can take effect while you’re alive and continue after your passing.

💡 Key Benefits of Having a Trust

• Avoids Probate: Assets in a trust bypass the lengthy and costly probate process.

• Privacy Protection: Unlike wills, trusts are not public record.

• Faster Distribution: Beneficiaries receive assets quickly, without court delays.

• Flexibility & Control: You decide how and when assets are distributed (e.g., children only receive funds at age 25).

• Tax Advantages: Certain trusts can reduce estate taxes.

• Protection for Loved Ones: Special needs trusts or spendthrift trusts can safeguard vulnerable beneficiaries.

🖼️ Relevant pages for study

Here are some websites you can use to learn more:

- Potential Benefits of a Trust | U.S. Bank

- The Benefits of Having a Trust vs a Will - Carrier Law

- Top 5 Benefits of a Trust to Secure Your Wealth in 2024 | Pace, CPA

- https://www.leaveawillnotabill.org/

🔑 Final Thoughts

A trust isn’t just for the wealthy—it’s for anyone who wants to protect their family, save money, and reduce stress. By setting up a trust, you’re giving your loved ones the gift of peace of mind and financial security.

👉 If you’re considering estate planning, talk to a qualified attorney to see which type of trust best fits your needs or ruse the pre-established network relationships at MWB. We have an attorney on our team of strategic partners. Consultation is free!

https://www.masterwealthbuildersllc.com/financial-eligibility-form

Recent Posts