Successful Financial Navigation in the Digital Age

Path to Financial Empowerment

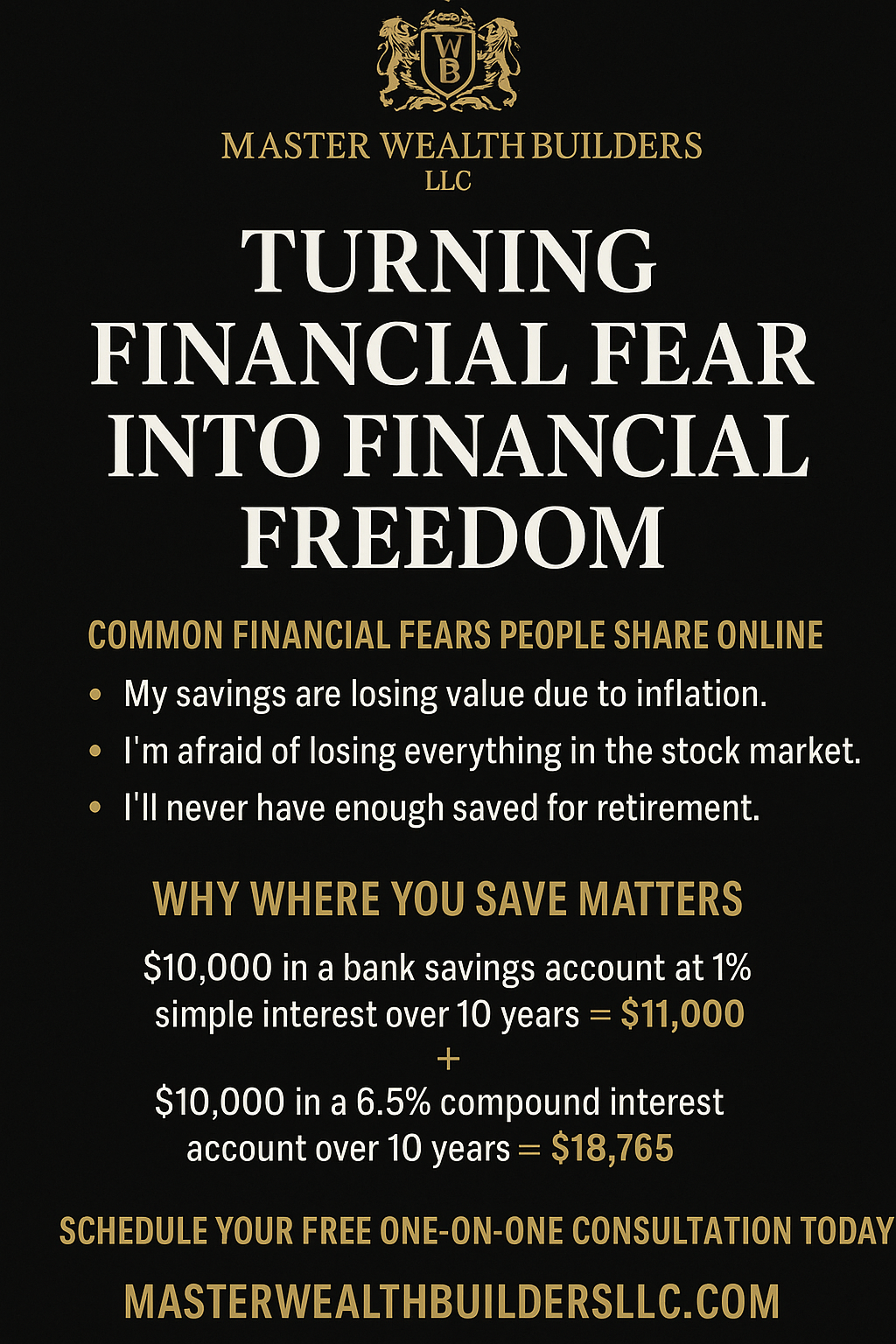

In today’s digital age, it’s impossible to ignore the constant flood of financial fears circulating online. From concerns about inflation, rising debt, recession talk, job security, and the unpredictable stock market—many people are left asking the same question: Where should I put my money to protect and grow it?

At Master Wealth Builders LLC, we believe the answer lies not just in how much you save, but where you save it.

---

Common Financial Fears People Share Online

1. “My savings are losing value due to inflation.”

With interest rates in traditional bank accounts averaging less than 1%, the value of your money often shrinks over time.

2. “I’m afraid of losing everything in the stock market.”

Market volatility can wipe out gains overnight if your money isn’t structured in a balanced, protective strategy.

3. “I’ll never have enough saved for retirement.”

Many people save consistently, but they save in places that don’t allow their money to work for them.

---

Why Where You Save Matters

Not all accounts are created equal. A simple interest savings account only grows your money based on your deposit. For example:

$10,000 in a bank savings account at 1% simple interest over 10 years = $11,000.

(You earned only $1,000 in a decade.)

Now compare this to the power of compound interest—interest that grows on both your deposit and the growth over time:

$10,000 in a 6.5% compound interest account over 10 years = $18,765.

(Your money nearly doubles without additional deposits.)

This is the difference between letting your money sleep in a bank account versus putting it to work in the right wealth-building vehicle.

---

Compound Interest Solutions That Work

At Master Wealth Builders, we specialize in strategies designed to maximize compound growth while protecting your money. Two powerful solutions we recommend exploring:

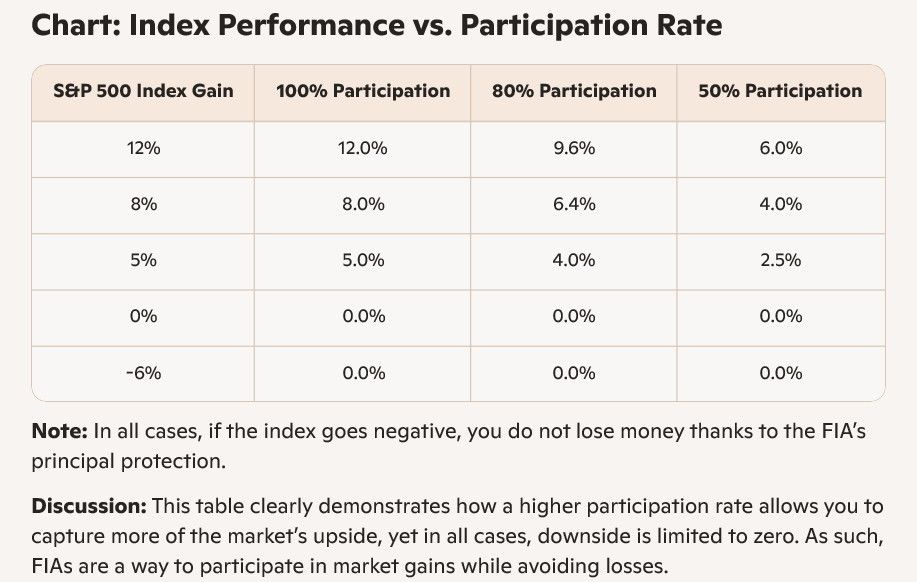

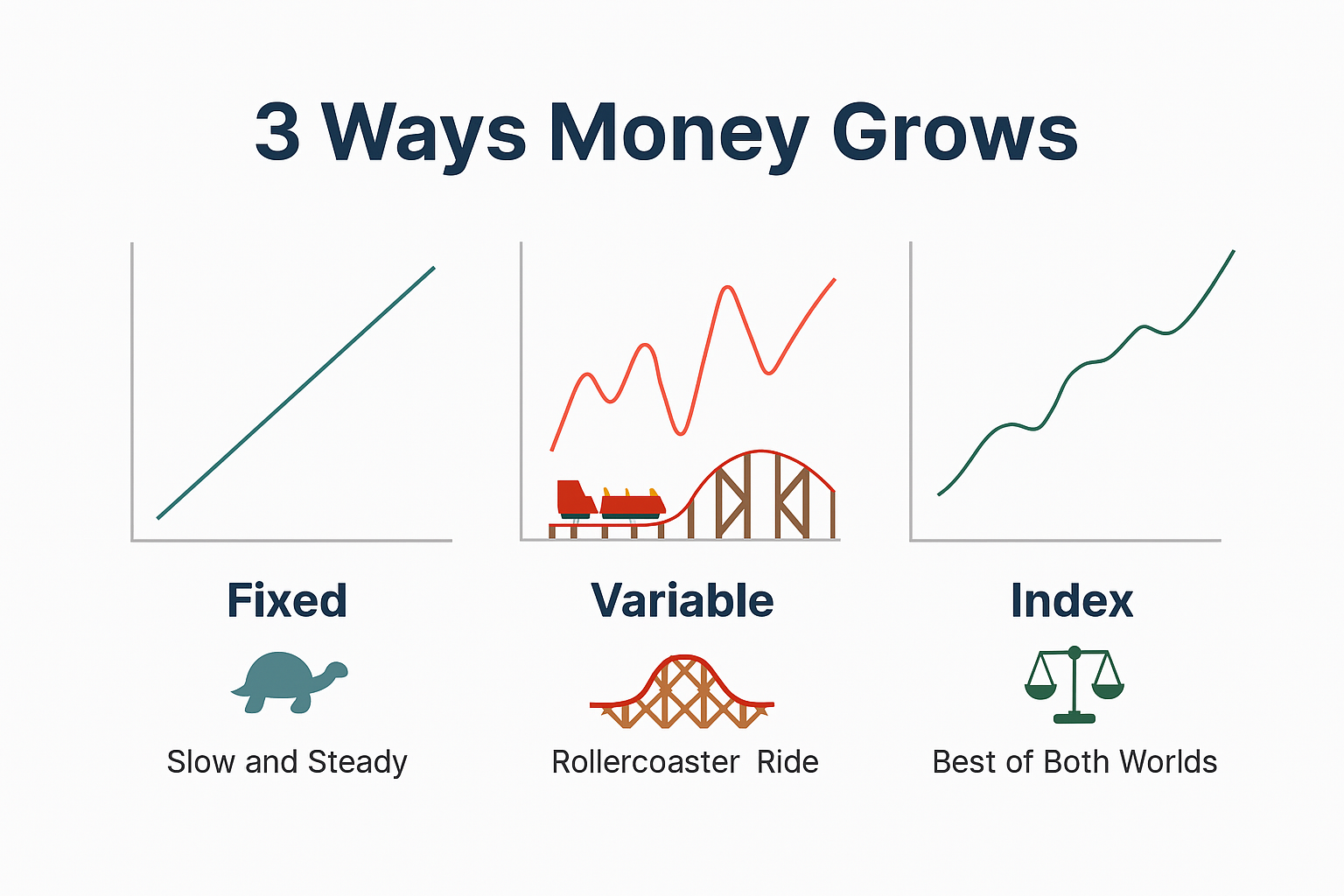

Fixed Index Annuities (FIA): Designed for growth with protection, these accounts offer market-linked returns without market losses.

Max-Funded Indexed Universal Life (IUL): A flexible financial tool that combines protection with the power of tax-advantaged compound growth.

Both strategies can help you save smarter, not just harder.

---

Take Control of Your Financial Future

The fears are real, but so are the solutions. You don’t have to let uncertainty about the economy dictate your future. Instead, put your money in accounts designed to multiply and outpace inflation.

Schedule your free one-on-one consultation today:

At Master Wealth Builders, our mission is to help you make fiscally responsible decisions today for the lifestyle you want tomorrow. Imagine a company designed to help you achieve your goals ️

by presenting available tools you may not have known existed. Lack of knowledge is not having exposure to what works, we open that door. What happens when you get to the shoreline, is up to you.