Path to Financial Freedom

Image a company designed to help you navigate through the fears of financial uncertainty

Good Debt vs. Bad Debt: How to Leverage Debt for Wealth-Building Opportunities

When most people hear the word “debt,” it sparks anxiety, fear, or even shame. Online discussions often warn us to “stay debt-free” at all costs. While being cautious with debt is wise, the reality is this: not all debt is created equal.

The difference between good debt and bad debt could determine whether your financial future is weighed down—or lifted into wealth.

---

What Is Bad Debt?

Bad debt is money borrowed for things that depreciate in value or don’t create income. It drains your resources instead of fueling growth.

Examples of bad debt include:

- High-interest credit cards used for lifestyle spending

- Payday loans or quick cash advances

- Financing luxury items that don’t hold long-term value

These types of debt can trap you in a cycle of payments with no return on your money.

---

What Is Good Debt?

Good debt, on the other hand, is money borrowed to create future income or appreciate in value. It’s the kind of debt that works for you, not against you. Examples of good debt include:

- A business loan that funds operations and produces consistent revenue

- A mortgage on rental property that generates positive cash flow

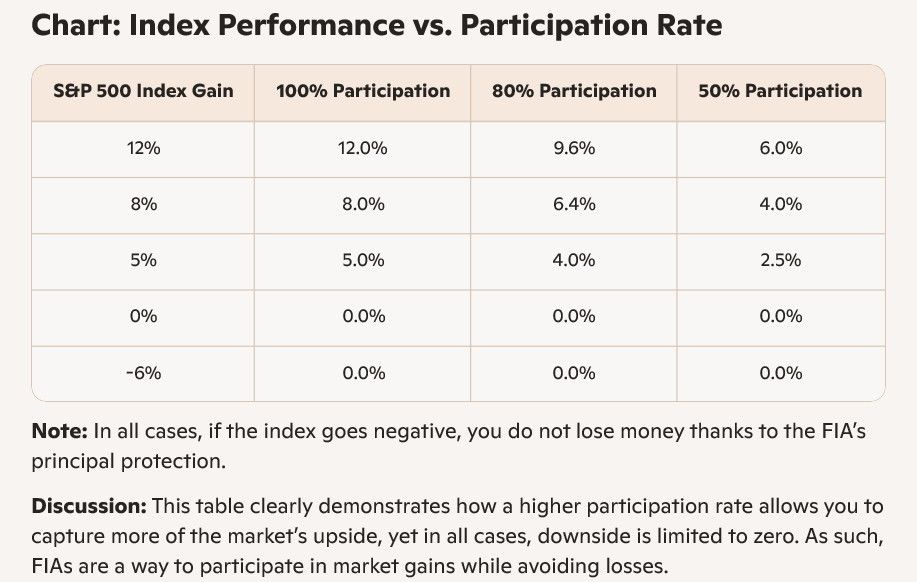

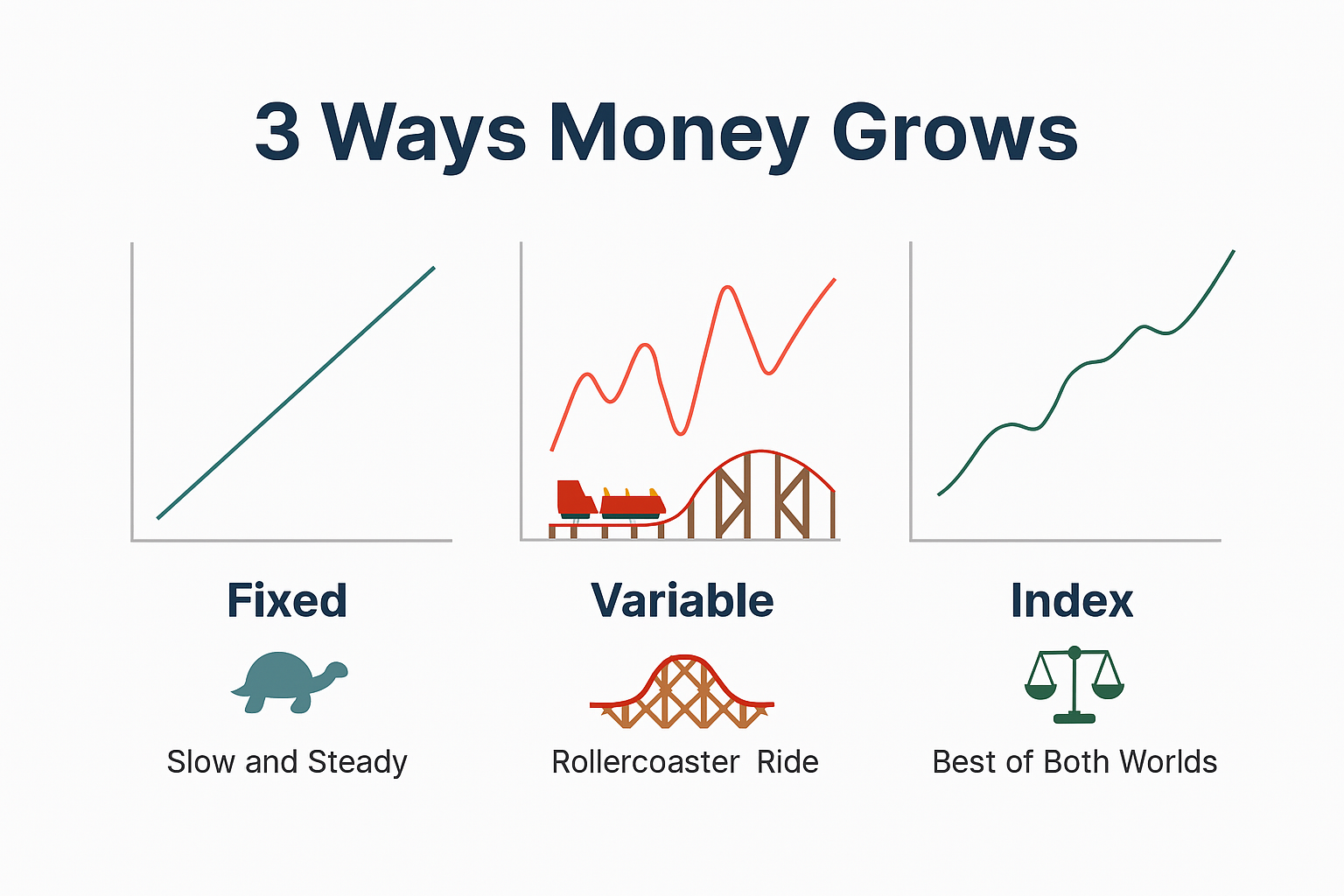

- Leveraging funds or redirecting funds to invest in compounding interest accounts such as Fixed Index Annuities (FIAs) or Max Fund IULs

The key? Good debt opens the door to high-return opportunities that outpace the cost of borrowing.

---

Example: Using Debt as a Lever

Imagine you borrow $20,000 at 5% interest to invest in a vehicle that earns 8–10% annually.

Your cost of debt is 5%.

Your return on investment is 8–10%.

That 3–5% spread becomes profit you wouldn’t have had otherwise—this is the power of leverage. Over time, compounding magnifies that gain. Net zero loan.

---

Why This Matters

If you only see debt as dangerous, you miss the chance to grow wealth strategically. The wealthy understand that debt is a tool: dangerous when misused, powerful when applied with knowledge and discipline.

---

The Master Wealth Builders Approach

At Master Wealth Builders LLC, our mission is to help you make fiscally responsible decisions today for the lifestyle you want tomorrow. We show clients how to:

- Avoid the traps of bad debt

- Leverage good debt into high-return strategies

- Use compounding interest accounts to multiply wealth

---

Ready to discover how you can turn debt into opportunity?

Schedule your free one-on-one consultation today:

Book Your Session Here

https://propps.me/masterwealthbuilders