Fixed Index Annuities vs. 401(k):

Unlocking Greater Financial Security

When planning for retirement, most people immediately think of their 401(k). While this employer-sponsored plan offers tax-deferred growth, it’s not the only solution available. For those seeking a more balanced approach to retirement income, Fixed Index Annuities (FIAs) provide a powerful alternative.

At Master Wealth Builders LLC, our mission is to elevate financial literacy by helping you understand the tools available to protect, grow, and preserve your wealth. Let’s explore why FIAs deserve a closer look compared to traditional 401(k) plans.

---

The Core Differences

1. Market Participation with Protection

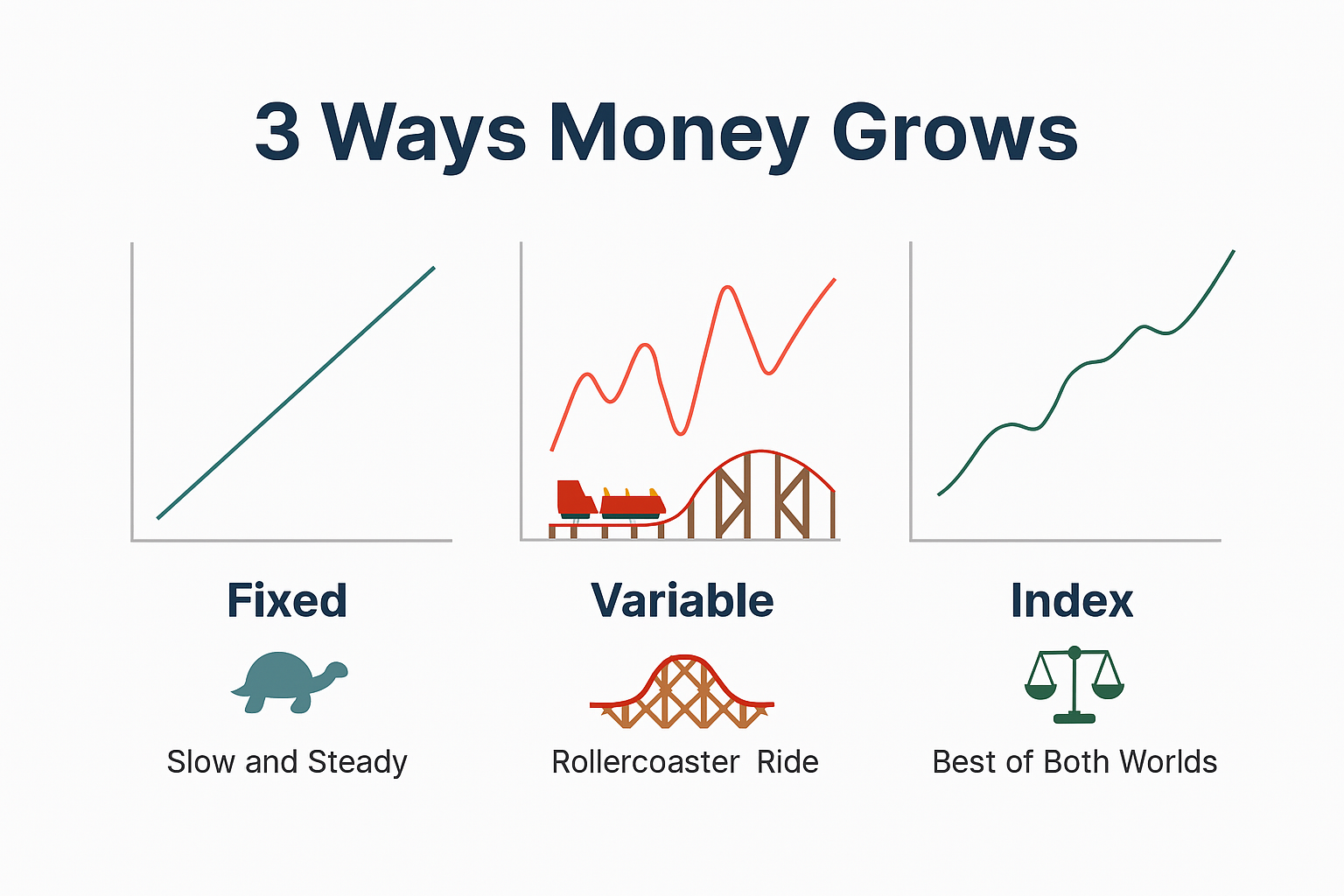

401(k): Investments are directly tied to the stock market. While this creates growth potential, it also exposes retirement savings to market downturns.

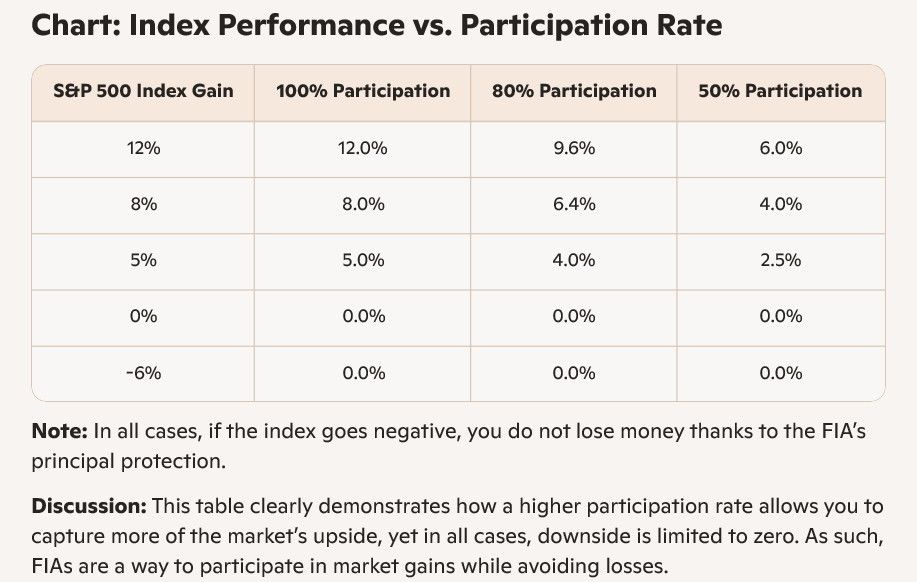

FIA: Returns are linked to a market index (like the S&P 500) but without direct market participation. This means no losses due to market declines—a unique balance of safety and growth.

2. Growth Potential

401(k): Unlimited growth potential, but it comes with full exposure to volatility.

FIA: Provides growth opportunities based on index performance, with ceilings (caps) but also powerful floors (protection). Your principal is shielded from downturns, ensuring peace of mind.

3. Income for Life

401(k): Once your balance runs out, so does your income. Longevity risk is on you.

FIA: Can be structured to provide a guaranteed lifetime income stream, reducing the risk of outliving your savings.

4. Tax Advantages

Both: Contributions can be tax-deferred, depending on the funding source.

Unique to FIAs: Flexible options for non-qualified funds, tax-deferred accumulation, and estate transfer benefits.

5. Flexibility & Control

401(k): Employer-sponsored, with limited investment options and strict rules around withdrawals.

FIA: Individual ownership, customizable riders for income, healthcare, or legacy planning.

---

Why FIAs Complement — Not Replace — a 401(k)

The key isn’t choosing one over the other. Instead, consider diversifying retirement strategies. A 401(k) can drive growth during working years, while an FIA can provide security, guaranteed income, and protection during retirement. Together, they create a balanced plan—growth when you need it, safety when it matters most.

---

Takeaway

In today’s unpredictable markets, financial literacy means understanding more than just your employer-sponsored plan. Fixed Index Annuities offer stability, protection, and lifetime income advantages that 401(k)s alone cannot guarantee.

At Master Wealth Builders LLC, we empower individuals and families to take control of their financial future with advanced solutions designed to protect and grow wealth.

Ready to explore how an FIA could fit into your retirement plan?

Visit Master Wealth Builders LLC and schedule a free consultation today.