Unlocking the Power of a Max-Funded IUL:

The Hidden Gem of Wealth Building

When most people think about wealth-building tools, they think of traditional retirement accounts, real estate, or even the stock market. But few are aware of one of the most powerful, flexible, and tax-advantaged strategies available today: the Max-Funded Indexed Universal Life (IUL) policy.

At Master Wealth Builders LLC, we believe financial literacy is the foundation of true financial freedom. Let’s break down why a Max-Funded IUL could be the cornerstone of your wealth strategy.

---

What Is a Max-Funded IUL?

An Indexed Universal Life policy is a type of permanent life insurance that combines:

- Lifelong insurance protection

- Cash value growth linked to a stock market index

- Powerful tax advantages

When structured correctly — max-funded — an IUL can become a tax-free wealth accumulation and distribution vehicle, far beyond its original purpose as life insurance.

---

Key Benefits of a Max-Funded IUL

1. Tax-Free Growth & Distribution

The cash value inside an IUL grows tax-deferred, and when accessed through policy loans, it can be distributed 100% tax-free. Imagine having a pool of money you can use without worrying about Uncle Sam cutting into your retirement.

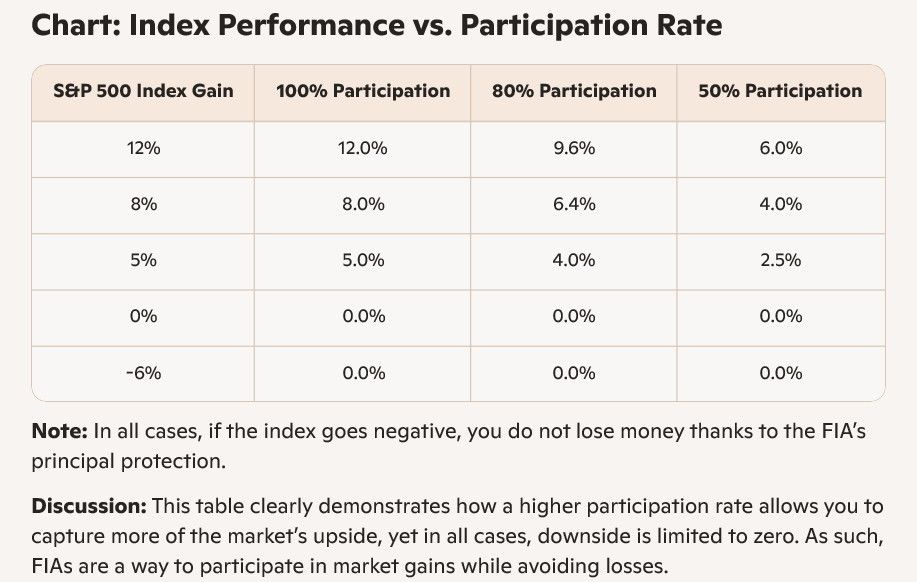

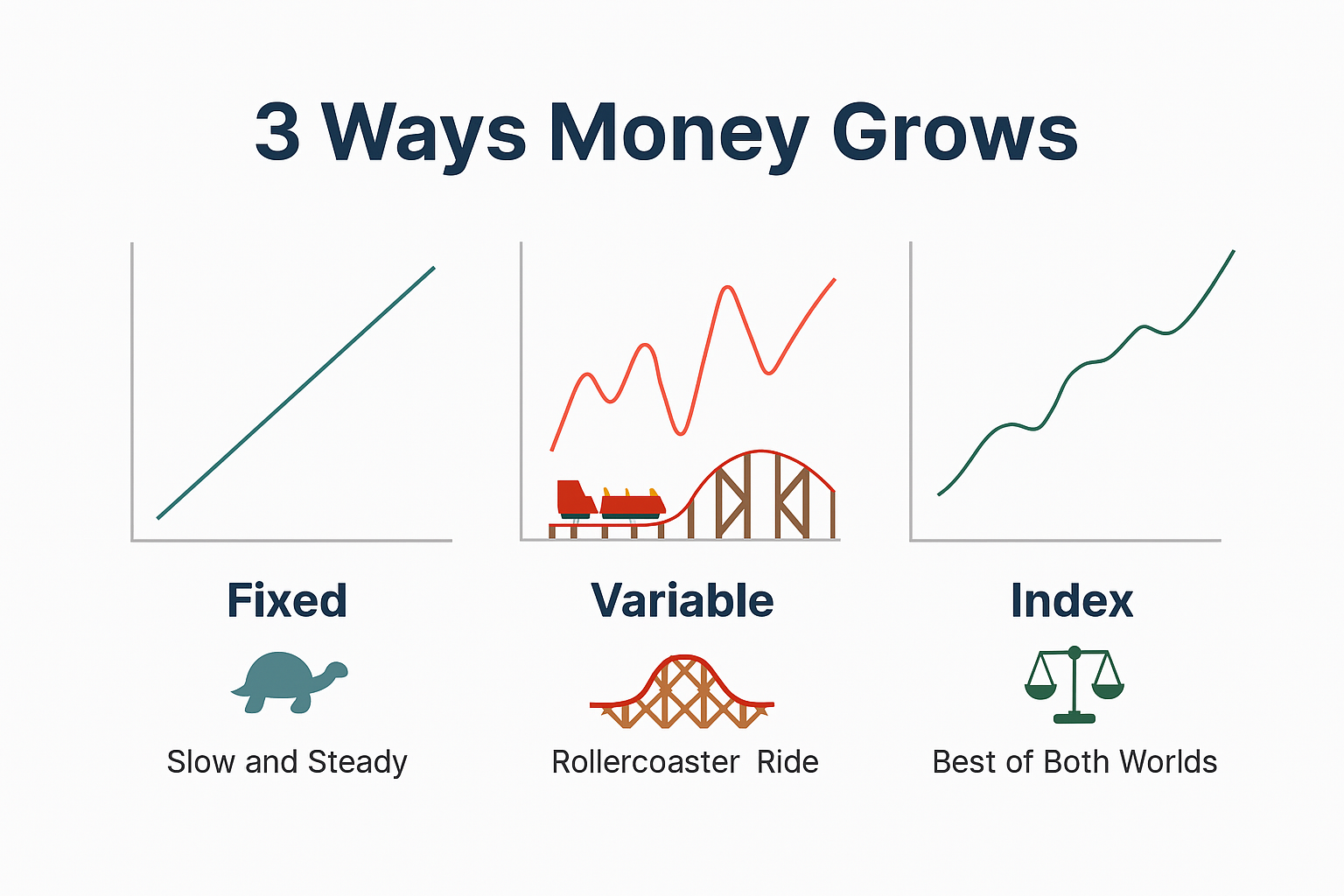

2. Market Growth Potential with Downside Protection

Your cash value earns interest based on a market index (like the S&P 500). Unlike direct investments, your principal is protected from market losses. You participate in gains but never suffer market downturns.

3. Unlimited Contributions

Unlike IRAs or 401(k)s, there are no contribution caps. You can fund the policy at a level that maximizes growth potential and leverages compounding without restriction.

4. Access to Funds Without Penalty

Need money before age 59 ½? No problem. With an IUL, you can access your cash value at any time — without IRS penalties. That means flexibility and liquidity when life requires it.

5. Built-In Legacy Planning

On top of wealth accumulation, your IUL provides a tax-free death benefit for your family. That means your money works for you during your lifetime and ensures a financial legacy for generations.

---

Why the Wealthy Leverage Max-Funded IULs

Banks, Fortune 500 CEOs, and wealthy families often use IULs as part of their advanced wealth strategies. Why? Because a properly structured IUL offers:

- Tax-free retirement income

- Protection from lawsuits & creditors (varies by state)

- Liquidity during market downturns

- A hedge against rising taxes

It’s not just life insurance — it’s a financial Swiss Army knife for wealth growth, protection, and transfer.

---

Take Action: Build Wealth on Your Terms

At Master Wealth Builders LLC, we specialize in designing customized max-funded IUL strategies that align with your goals. Whether you’re looking to reduce taxes, create guaranteed retirement income, or leave a lasting legacy, this strategy could be the missing piece of your financial puzzle.

Schedule Your Free Consultation Today

Your path to financial freedom starts with a conversation. Visit Master Wealth Builders LLC and book your free consultation. Let’s build a strategy that works for you and your family — today, tomorrow, and for generations to come.