Don’t Simply Retire. Retire with Kai-Zen®

The 5-Year Retirement Plan

Retirement isn’t merely the end of your career—it’s a milestone meant to herald a more fulfilling, secure, and prosperous stage of life. The key? Transition from merely retiring to something great—not just from something. New definition of retirement; time freedom, moving from what you have to do towards doing what you want to do.

One Strategy, Exponentially Stronger Outcomes

Enter Kai-Zen®, an innovative retirement strategy developed by NIW Corp. that lets you supercharge your savings using leverage—giving you up to 3x more money to fund a unique cash-accumulating insurance policy.

Coupling your contributions with selective bank financing, Kai-Zen unlocks the potential for accelerated growth while providing the protections inherent in life insurance, including death and living benefits.

Why Kai-Zen Stands Out:

1. Maximized Retirement Savings via Leverage

High-income earners can pair personal savings with institutional financing—multiplying capital at work in your policy. It’s a strategic boost beyond traditional retirement vehicles.

2. Tax-Advantaged Growth and Withdrawals

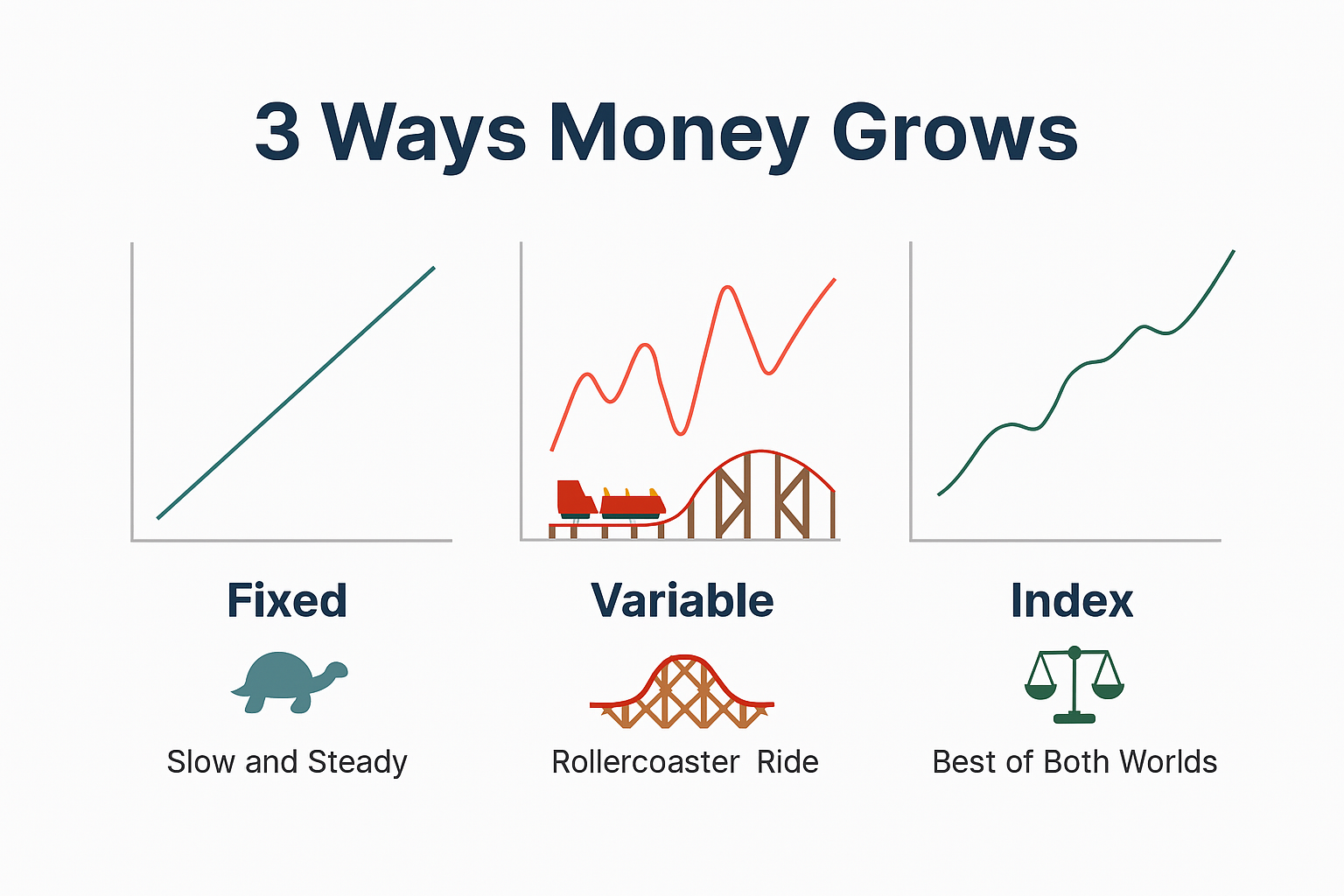

Built on an indexed universal life (IUL) insurance structure, Kai-Zen’s cash value grows tax-deferred. Later, you can access this value through policy loans or withdrawals, often tax-free—providing flexible income in retirement.

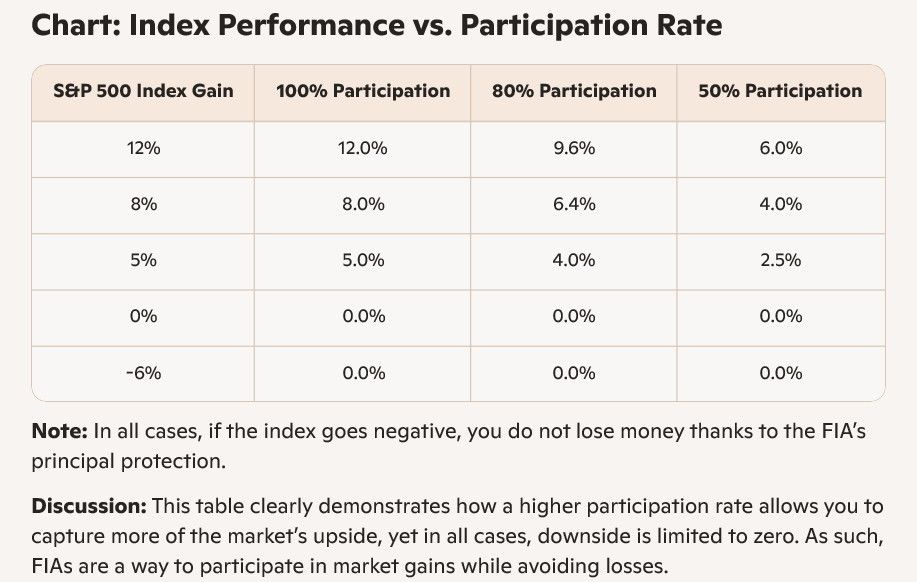

3. Protection from Market Fluctuations

The IUL portion allows upside market participation without downside exposure—offering upside potential while preserving principal through downturns.

4. Built-In Safety Nets

Banks lend against the policy’s cash value—no personal guarantee required. Loans are repaid from within the policy itself, limiting your liability.

5. Resilience in Rising Interest Rate Environments

While increased interest can pressure financing, Kai-Zen is structured with built-in safeguards—designed to perform even when borrowing costs rise.

6. Credit, Clarity & Compliance for Institutional Partners

Banks favor Kai-Zen due to transparent policy structure, secure collateral, and consistent administration—making it a stable and scalable financing option.

What the Kai-Zen Strategy Looks Like in Practice

According to Insurance & Estates, the premium financing often proceeds in phases—your contributions may fund the policy initially (years 1–5), followed by bank 3:1 leverage in the next phase, compounding growth through year 15 and beyond.

"Safe Money Lady" outlines the core approach:

Establish a high-cash-value IUL policy,

Use bank matching for contributions,

Benefit from protected growth, and

Extract income later via tax-free policy loans.

Who Stands to Benefit Most

Kai-Zen is ideal for:

- High-net-worth professionals and executives seeking powerful, tax-efficient retirement vehicles.

- Those maximizing retirement income beyond traditional limits.

- Individuals looking for a flexible, protected, and tax-smart liquidity strategy.

- People who can commit to funding early years but want control and growth access later.

- Smart, Strategic, Sophisticated

Required Qualifications:

- Your combined household income is at least 100k per year.

- You are between the ages of 18 - 65.

- You are in average or good health.

- You can contribute a minimum of $22k per year.

Why Kai-Zen®

We have all used leverage to purchase a nicer house or to buy a better car. Kai-Zen uses leverage for the potential to accumulate more growth & obtain more protection, while providing the ability to maintain your current standard of living. That’s the smart way to use leverage.

Kai-Zen isn’t just another financial product—it’s a forward-thinking, disciplined, and highly structured system designed to deliver powerful results, tax efficiency, and protection simultaneously. Perfect for employee retention and attraction.

---

Ready to Make Kai-Zen Work for You?

Let’s explore whether Kai-Zen aligns with your retirement vision. Schedule your complimentary consultation now with Master Wealth Builders:

Step into a retirement that doesn’t just sustain—but elevates.

---

If you’d like to dive deeper into illustrations, risk scenarios, or compare this with traditional retirement options, just let me know—I’ll be happy to help.

To your success,

TK Pryor

Wealth Strategist | Master Wealth Builders